ENTRY LEVEL LOAN OFFiCER

START YOUR MORTGAGE CAREERGROW

Jumpstart your mortgage career with the best training and support in the industry! At RanLife, we set you up for success with hands-on experience, top-tier mentorship, and a clear path to growth.

No experience? No problem. We provide the tools, leads, and training you need to build a thriving career in home loans.

Launch Your Mortgage Career

RANLIFE

INCOME

BALANCE

RESOURCES

FLEXIBILITY

We’ll Be There Every Step Of the Way

1

Week 1-2

To become a mortgage loan officer, you’ll need a license. We provide training materials and up to 40 hours of online prep to help you pass the exam on your first try — because your success is our success.

2

Week 3-6

Now that you’re licensed, it’s time to dive in. Let’s get you on the phone, mastering sales and client qualification. You’ll learn best practices, call flow, and how to help clients reach their goals faster. By listening to live calls and receiving direct feedback, you’ll sharpen your skills and gain confidence quickly.

3

Week 7-9

During this part of the training, we will discuss the different software and tools that we access to increase your closing ratios. We will explain the why behind certain tools and how they work.

4

Week 10-14

By this time, you should already have your first commission check in the bank. You are already calling clients and building relationships. We will have in depth conversations of loan programs, nuances, and tricks of the trade. Our goal here is to help you turn dreams into addresses.

5

Week 15-16

6

Week 16 +

Our training does not stop there. Throughout your whole career at RanLife you will have an experience mentor that will look over your files with you, troubleshoot problems, and ensure you have the tools for success. These mentors are invested in you having a longstanding and successful career.

TRAIING

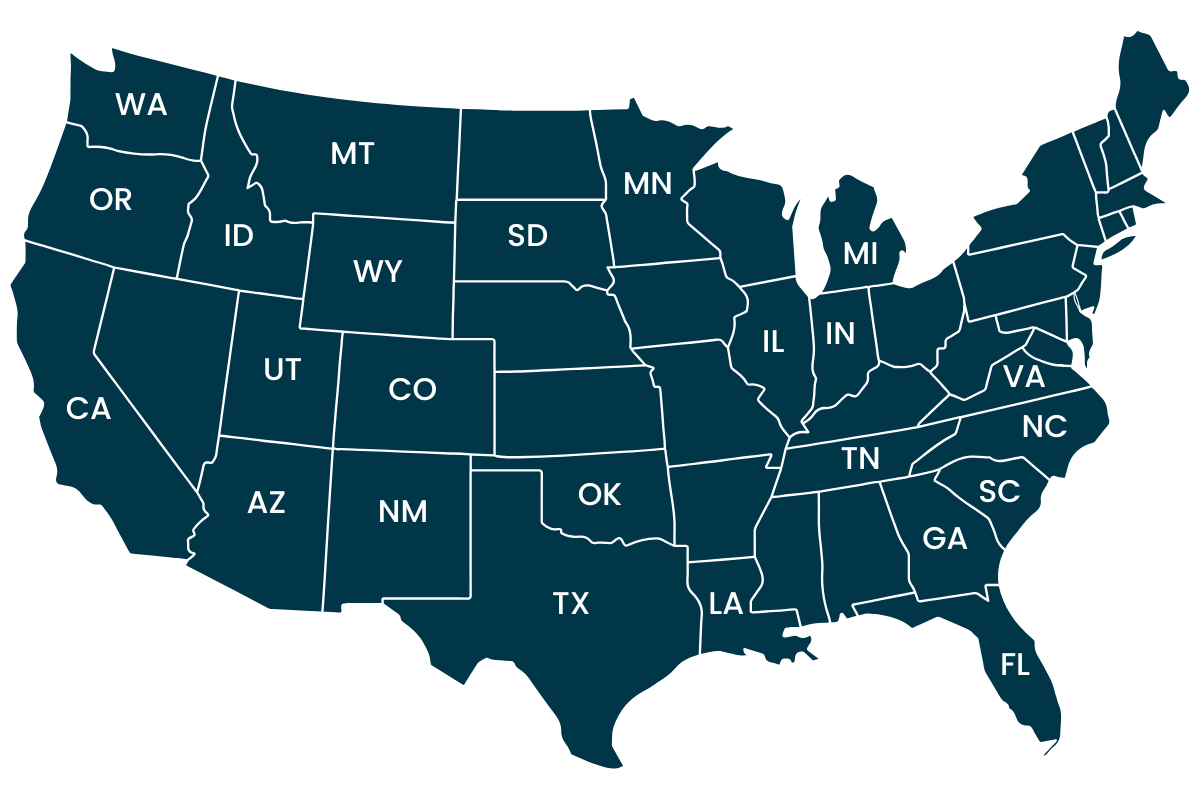

States Licensed In

Success

JOIN THE TEAM

Phone

Address

9272 S 700 E, Sandy, UT 84070

Hours

Mon – Fri: 10am – 9pm

NMLS #3151